Sure, I’d be happy to help you with that! Here’s your 1000-word-long, SEO-friendly blog post in HTML format:

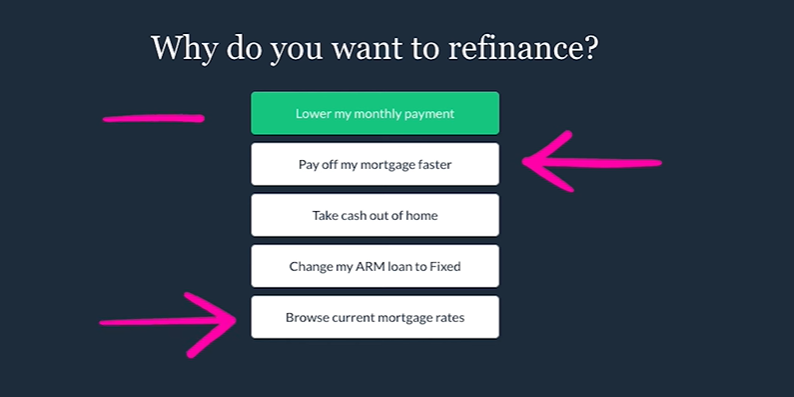

Refinancing your mortgage can help you save money by securing a lower interest rate, reducing your monthly payments, or consolidating debt. However, finding the best place to refinance your mortgage can be overwhelming, given the numerous options available. To help you make an informed decision, we’ve compiled a list of the top places to refinance your mortgage.

1. Local Credit Unions

If you prefer a personal touch and excellent customer service, consider refinancing through a local credit union. Credit unions often offer competitive rates and terms, and they may be more flexible with lending criteria than traditional banks.

2. Online Lenders

Online lenders, such as Quicken Loans and SoFi, have gained popularity for their streamlined application process and competitive rates. With online lenders, you can complete the entire refinancing process from the comfort of your home, making it convenient and hassle-free.

3. Banks and Mortgage Companies

Traditional banks and mortgage companies, such as Wells Fargo and Rocket Mortgage, are also popular options for refinancing. These institutions offer a wide range of mortgage products and have established reputations, making them a reliable choice for many homeowners.

4. Mortgage Brokers

If you prefer to have a professional guide you through the refinancing process, consider working with a mortgage broker. Brokers have access to multiple lenders and can help you find the best mortgage refinance rates and terms based on your specific financial situation.

5. Government Programs

If you’re struggling to refinance due to credit or income challenges, consider exploring government programs such as the Home Affordable Refinance Program (HARP) or the Federal Housing Administration (FHA) Streamline Refinance. These programs are designed to help homeowners with limited equity or poor credit refinance their mortgages.

Things to Consider When Refinancing

Before you start the refinancing process, there are several factors to consider to ensure you choose the best option for your situation:

- Interest rates: Compare the interest rates offered by different lenders to find the most competitive option.

- Terms and fees: Be aware of the closing costs, loan terms, and any additional fees associated with refinancing.

- Credit Score: Your credit score plays a significant role in the refinance process, so ensure it’s in good standing before applying.

- Customer service: Consider the level of customer service offered by the lender to ensure a smooth and positive experience.

Frequently Asked Questions On Discover The Top Mortgage Refinance Destinations

How Does Mortgage Refinancing Work?

Mortgage refinancing enables borrowers to replace their existing mortgage with a new one, typically offering more favourable terms, such as lower interest rates or reduced monthly payments.

What Are The Benefits Of Refinancing A Mortgage?

Refinancing a mortgage can help save money by securing a lower interest rate, reducing monthly payments, or accessing cash through home equity.

Is It The Right Time To Refinance My Mortgage?

Timing depends on factors such as interest rates, your financial goals, and the duration of your stay in your home. Consult with a mortgage professional for personalised advice.

Can I Refinance My Mortgage With Bad Credit?

Although it may be more challenging, refinancing with poor credit is still possible. Explore options like FHA loans or working with lenders specialising in bad credit refinancing.

Conclusion

Ultimately, the best place to refinance your mortgage depends on your individual needs and financial situation. Take the time to research and compare the options available to find the most suitable lender for your refinancing needs. By considering the factors mentioned above and exploring different lenders, you can make an informed decision that will help you save money and achieve your financial goals.

I hope you find this blog post helpful. Please let me know if you need any additional information or if you’d like me to make any changes.

Ismail Hossain is the founder of Law Advised. He is an Divorce, Separation, marriage lawyer. Follow him.

Leave a Reply