Are you ready to buy your dream home? One of the first steps towards homeownership is getting a mortgage pre-approval. In this blog post, we will explore the process of getting pre-approved for a mortgage with Bank of America, one of the leading banks in the United States.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a preliminary assessment from a lender that indicates how much money you can borrow to buy a home. It involves reviewing your financial Information, credit score, and other relevant factors to determine your eligibility for a mortgage.

The Benefits of Mortgage Pre-Approval

Obtaining a mortgage pre-approval from Bank of America can significantly benefit you in the home-buying process. Here are some advantages:

- Know Your Budget: Pre-approval gives you a clear understanding of how much you can afford to spend on a home. This knowledge helps you search for properties within your budget.

- Increased Negotiating Power: Sellers often prioritize buyers who have been pre-approved for a mortgage. It shows that you are a serious buyer and increases your chances of having your offer accepted.

- Streamlined Process: Pre-approval helps speed up the mortgage application process once you find the right home. It eliminates the need to wait for approval after making an offer.

- Rate Lock: If interest rates increase between pre-approval and closing, Bank of America can honor the lower rate you were pre-approved for.

The Mortgage Pre-Approval Process with Bank of America

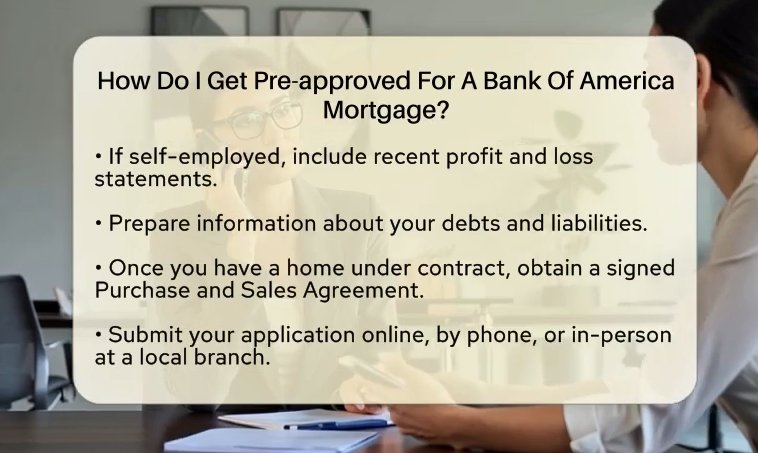

Getting pre-approved for a mortgage with Bank of America is a straightforward process. Here are the steps involved:

- Gather Your Financial Information: Prepare your income documentation, bank statements, and other relevant financial Information.

- Complete an Application: Visit the Bank of America website or speak with a mortgage loan officer to complete the mortgage pre-approval application. Provide accurate and detailed Information.

- Credit Check: Bank of America will review your credit report and credit score.

- Verification of Information: The bank may request additional documents to verify your income, employment, and assets.

- Receive Your Pre-Approval: Once all Information is reviewed, Bank of America will provide you with a pre-approval letter detailing the amount you are pre-approved for.

Key Factors Considered for Mortgage Pre-Approval

Bank of America considers several factors when determining your mortgage pre-approval. These factors include:

- Income and employment history

- Credit score and credit history

- Total monthly debts

- Assets and savings

- Down payment amount

Next Steps After Mortgage Pre-Approval

After receiving your pre-approval letter from Bank of America, it’s time to embark on your home-buying journey. Here are some necessary next steps to consider:

- Find a Real Estate Agent: Enlist the help of a trusted real estate agent who can assist you in finding your dream home.

- Explore Mortgage Options: Connect with a Bank of America mortgage loan officer to discuss different mortgage options and choose the one that best suits your needs.

- Start House Hunting: Utilize online listings, attend open houses, and visit neighborhoods that interest you. Keep in mind your pre-approval amount as you search for properties.

- Make an Offer: When you find the perfect home, work with your real estate agent to submit an offer to the seller.

- Complete the Mortgage Application: Once your offer is accepted, proceed with completing the whole mortgage application process with Bank of America.

- Finalize the Mortgage: Work closely with the bank to provide any additional documentation and complete the necessary steps to finalize your mortgage.

- Closing: Finally, attend the closing to sign the documents and become a proud homeowner!

In Conclusion

Getting pre-approved for a mortgage with Bank of America is an essential first step in your home-buying journey. It provides clarity on your budget, increases your negotiating power, and streamlines the entire process. By following the steps outlined in this article, you’ll be well on your way to securing the mortgage pre-approval you need to buy your dream home.

Frequently Asked Questions Of Bank Of America Mortgage Pre-Approval: Your Path To Homeownership

How Do I Get Pre-Approved For A Mortgage With Bank Of America?

To get pre-approved for a mortgage with Bank of America, you can start by completing an online application or contacting a mortgage loan officer for personalized assistance.

What Are The Benefits Of Getting A Mortgage Pre-Approval?

By getting a mortgage pre-approval, you can understand your budget, strengthen your offer, and have more negotiating power when buying a home.

How Long Does It Take To Get Pre-Approved For A Mortgage?

The pre-approval process can take several days, but it depends on various factors such as the complexity of your finances and the documentation you provide.

What Factors Are Considered During The Mortgage Pre-Approval Process?

Bank of America considers factors such as your credit score, income, employment history, debt-to-income ratio, and the amount of down payment you can afford.

Ismail Hossain is the founder of Law Advised. He is an Divorce, Separation, marriage lawyer. Follow him.

Leave a Reply