A reverse mortgage is a financial tool that allows homeowners who are 62 years or older to convert part of their home equity into cash. Often, reverse mortgages are advertised by various companies, but one company that stands out is AAG (American Advisors Group). AAG has gained attention not only for its expertise in reverse mortgages but also for its partnership with the beloved actor, Tom Selleck.

Who is AAG?

AAG is a leading provider of reverse mortgages in the United States. With its headquarters in Orange County, California, AAG has been helping seniors achieve financial security and independence for over a decade. AAG offers a variety of reverse mortgage products and services tailored to meet the unique needs of each homeowner.

Why Choose AAG?

There are several reasons why AAG is the preferred choice for many homeowners considering a reverse mortgage:

- Expertise: AAG has specialized in reverse mortgages since its inception, giving it extensive knowledge and experience in this field.

- Financial Stability: AAG is a trusted lender, and its financial strength allows it to provide competitive rates and favorable loan terms.

- Personalized Service: AAG understands that every homeowner’s situation is unique, so they provide personalized guidance and support throughout the entire process.

- Government Approved: AAG is an FHA (Federal Housing Administration) approved lender, ensuring that their reverse mortgage products meet the highest standards.

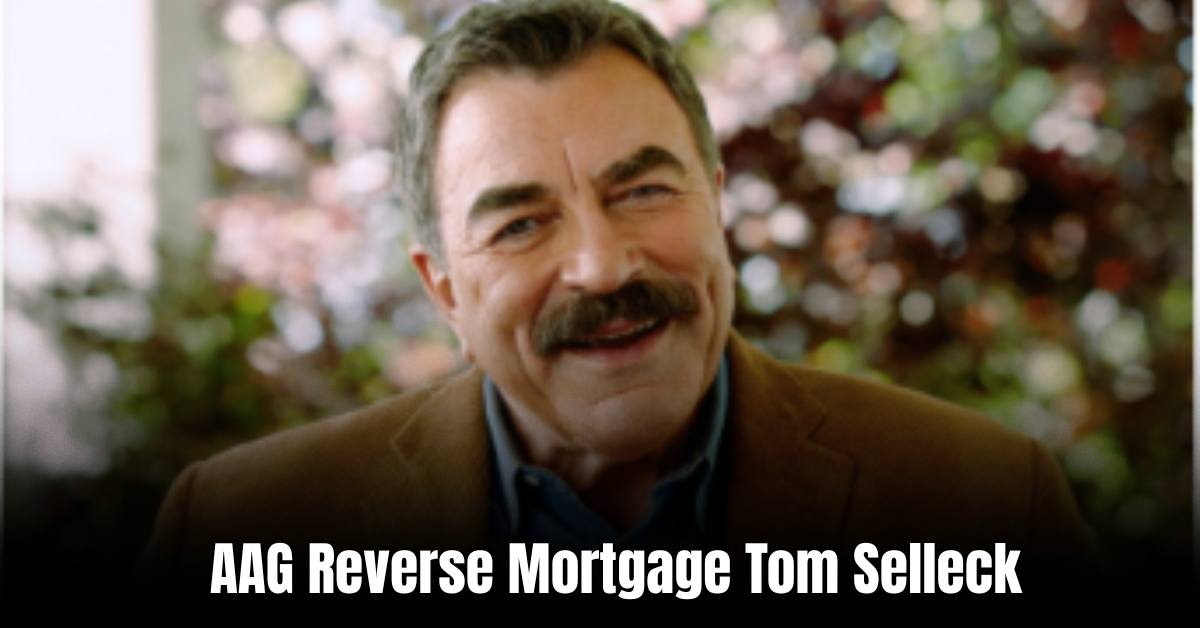

Introducing Tom Selleck

Many people may know Tom Selleck as the charismatic actor from popular TV shows and movies. However, Selleck has also taken on the role of spokesperson for AAG, appearing in their commercials and sharing his own positive experience with reverse mortgages.

Tom Selleck’s endorsement brings credibility and trust to AAG. As a well-respected actor, Selleck’s association with AAG reassures homeowners that AAG is a reliable and reputable company.

Benefits of AAG Reverse Mortgages

AAG offers a range of benefits to homeowners who choose their reverse mortgage services:

| Benefit | Description |

|---|---|

| Flexible Payment Options | AAG provides various payment options for borrowers, including lump sum, line of credit, fixed monthly payments, or a combination of these. |

| No Monthly Mortgage Payments | With a reverse mortgage, homeowners are not required to make monthly mortgage payments as they would with a traditional mortgage. |

| Tax-Free Proceeds | The funds received from a reverse mortgage are typically tax-free, allowing homeowners to use the money as needed without tax implications. |

| Ownership Retained | Homeowners retain ownership of their homes as long as they continue to meet the loan obligations, such as paying property taxes and homeowners insurance. |

| Non-Recourse Loan | A reverse mortgage is a non-recourse loan, which means that borrowers or their heirs will never owe more than the appraised value of the home when the loan becomes due. |

Is AAG Right for You?

Before deciding on a reverse mortgage, it’s essential to evaluate your financial goals and consult with a reverse mortgage specialist. They can help determine if a reverse mortgage is the right solution for your individual circumstances.

While AAG and Tom Selleck provide reputable and credible options for reverse mortgages, it’s crucial to do thorough research and consider all available options before making a final decision.

Remember, a reverse mortgage is a significant financial step, and it’s always wise to seek professional advice and fully understand the terms and responsibilities associated with the loan.

Disclaimer: This article is for informational purposes only and should not be considered financial or legal advice. Consult with a trusted financial advisor or reverse mortgage specialist for personalized guidance.

Frequently Asked Questions Of Aag Reverse Mortgage Tom Selleck: Unlock Your Home’s Equity Today

How Does Aag Reverse Mortgage Work?

AAG Reverse Mortgage allows homeowners to convert a portion of their home equity into loan proceeds. No monthly mortgage payments are required, and the loan is repaid when the homeowner leaves the home.

What Are The Eligibility Requirements For Aag Reverse Mortgage?

To qualify for an AAG Reverse Mortgage, you must be at least 62 years old, own your home, and use it as your primary residence. The home should meet certain requirements, and you should have sufficient equity.

Can I Lose My Home With an AAG Reverse Mortgage?

With an AAG Reverse Mortgage, as long as you meet the obligations of the loan agreement, you can continue to live in your home. However, if you fail to pay property taxes, insurance, or maintain your home, you could face foreclosure.

How Much Money Can I Get With an AAG Reverse Mortgage?

The amount you can receive with an AAG Reverse Mortgage depends on several factors, including your age, the value of your home, current interest rates, and the specific loan program you choose. A loan specialist can provide you with an estimate.

Ismail Hossain is the founder of Law Advised. He is an Divorce, Separation, marriage lawyer. Follow him.

Leave a Reply