Category: Mortgage

-

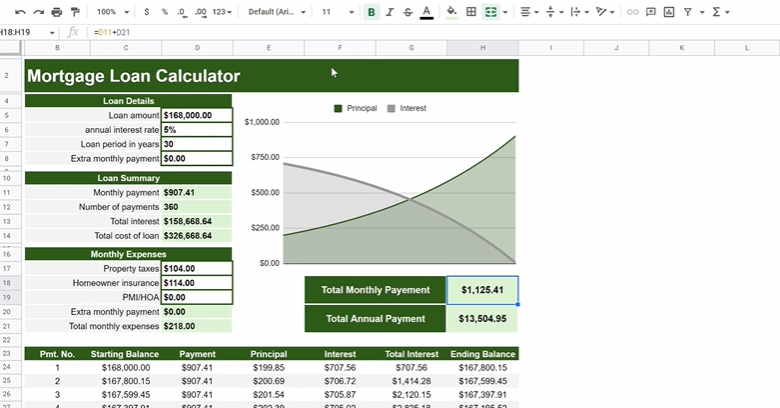

Mortgage Calculator Formula Google Sheets : Optimize Your Financing Plans

Are you considering buying a new home or refinancing your current mortgage? Understanding your mortgage payments iscrucial in making informed financial decisions. Thanks to modern technology, you can easily calculate your mortgagepayments using Google Sheets. What is Google Sheets? Google Sheets is a free, web-based spreadsheet program offered by Google. Similar to Microsoft Excel, it…

-

Best Mortgage Lenders Los Angeles: Unlock the Power of Homeownership Today

Welcome to our guide on the best mortgage lenders in Los Angeles. Whether you’re a first-time homebuyer or looking to refinance, finding the right mortgage lender is crucial. Los Angeles is a diverse city with a highly competitive real estate market, so it’s essential to select a lender that understands the local market and offers…

-

Does Newrez Mortgage Have a Grace Period: Your Essential Guide

When it comes to mortgage payments, having a grace period can provide some much-needed flexibility and peace of mind. If you’re considering a mortgage with Newrez, you may wonder if they offer a grace period. In this article, we will explore the concept of a grace period, how it works, and determine whether Newrez Mortgage…

-

Best Mortgage Lenders in Utah: Top-Rated Home Loan Providers

If you’re looking to buy a home in Utah, finding the right mortgage lender is an essential part of the process. Your mortgage lender plays a crucial role in helping you secure the financing you need to purchase your dream home. With so many options available in the market, it can be overwhelming to choose…

-

What Happens to a Private Mortgage When the Lender Dies: Unraveling the Mystery

When a person dies, there are many legal and financial matters that need to be addressed. One such matter is what happens to any outstanding debts or obligations, including private mortgages. In this article, we will explore what happens to a private mortgage when the lender dies. What is a Private Mortgage? A private mortgage,…

-

Wells Fargo Payoff Amount Mortgage: How to Determine Your Mortgage Payoff for a Smooth Financial Journey

If you are a homeowner with a mortgage, you may be wondering how to determine the payoff amount for your Wells Fargo mortgage. In this article, we will guide you through the process of finding out your mortgage payoff amount and explain why it is important. What is a Payoff Amount? The payoff amount is…

-

Freedom Mortgage Bought My Loan : Securing Your Financial Future

Have you heard? Freedom Mortgage recently purchased my home loan, and I couldn’t be happier with the transition. In this blog post, I will share my experience with Freedom Mortgage and how they made the entire process seamless and stress-free. Let’s dive in! Who is Freedom Mortgage? Freedom Mortgage is a leading mortgage lender founded…

-

Best Mortgage Rates for Second Home : Secure Your Dream Property Now

Are you dreaming of owning a second home? Whether it’s a vacation getaway or an investment property, finding the best mortgage rates is essential to make your dream a reality. In this article, we will guide you on how to secure the best mortgage rates for your second home. 1. Research and Compare Mortgage Lenders…

-

Wells Fargo Grace Period on Mortgage: The Ultimate Guide to Avoiding Late Fees and Navigating the Process

Are you a Wells Fargo mortgage customer? Have you ever wondered about the grace period on your mortgage payments? If so, you’re in the right place! In this article, we’ll explore what the grace period means, how it works at Wells Fargo, and what you need to know to make the most of it. What…

-

What Happens If I Double My Mortgage Payment: Unlocking Financial Freedom

Have you ever wondered what would happen if you doubled your mortgage payment? Many homeowners are uncertain about the benefits of making larger payments towards their mortgage, but the truth is that it could have a significant impact on your financial future. In this article, we will explore the advantages of doubling your mortgage payment…