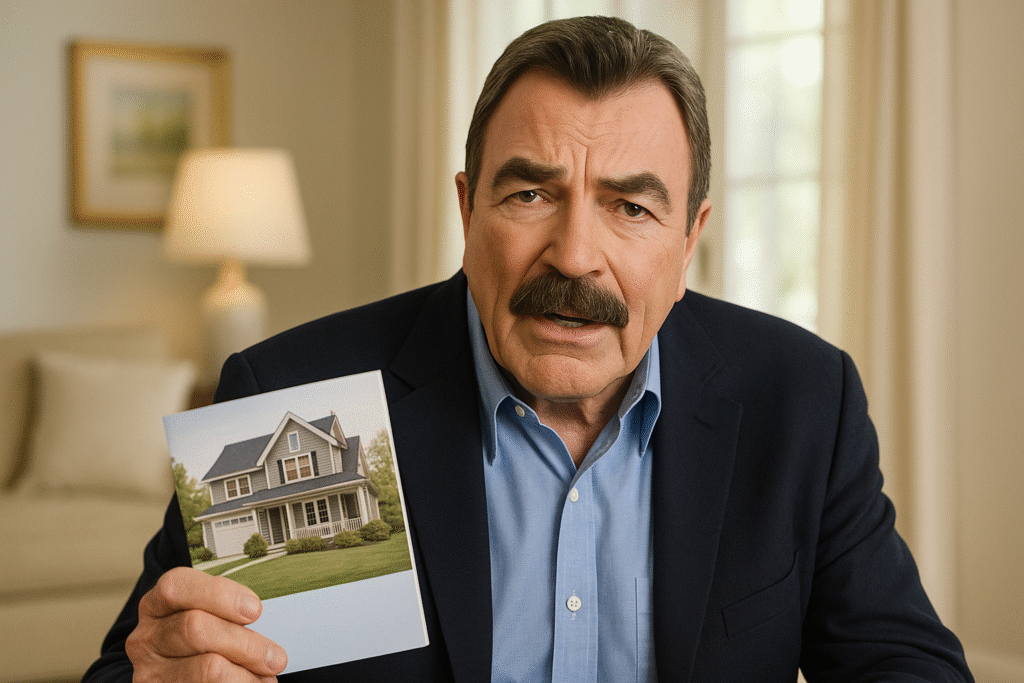

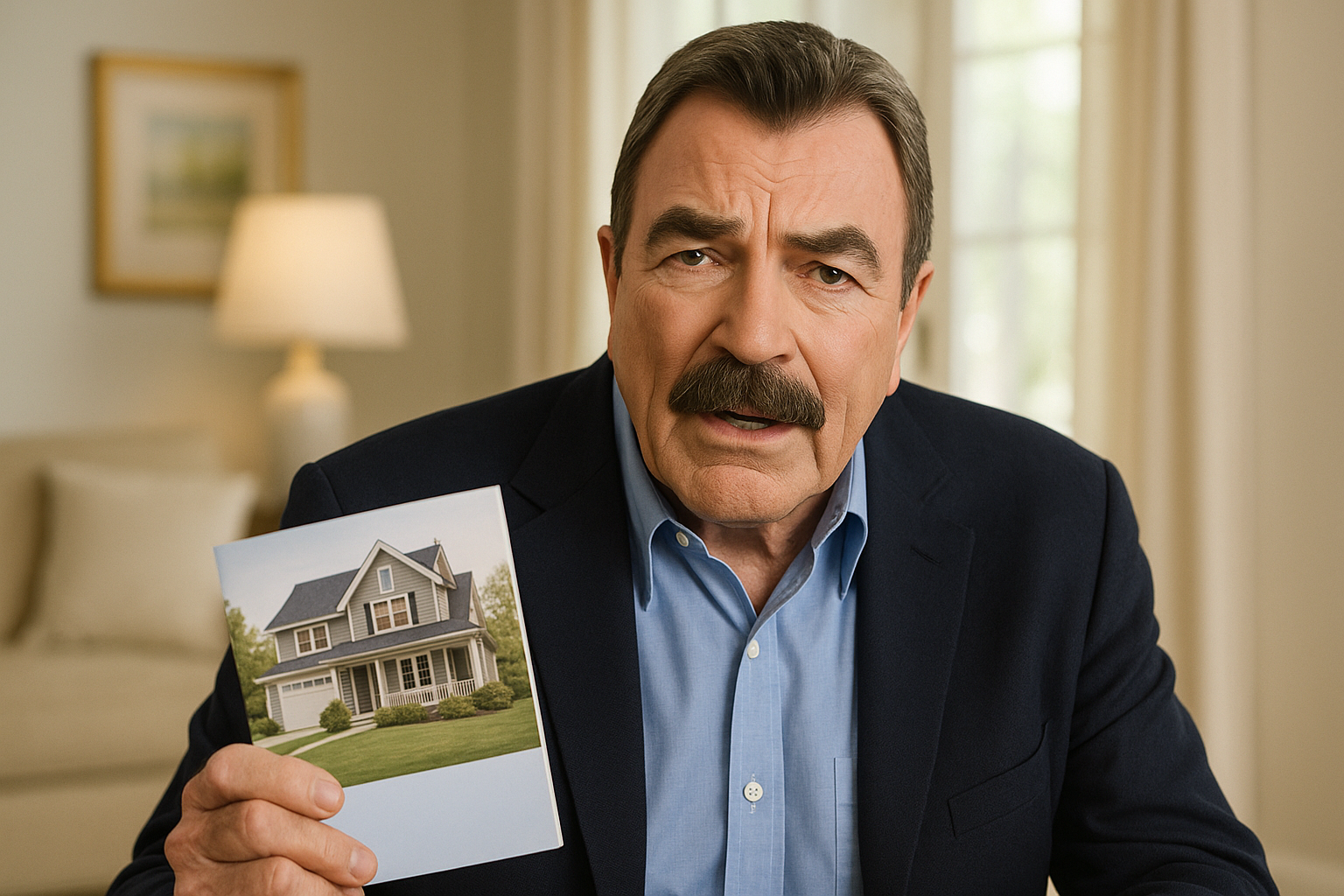

Tom Selleck, known for his iconic roles in Magnum, P.I., and Blue Bloods, has recently become the spokesperson for reverse mortgages. But what exactly is a reverse mortgage, and why is Tom Selleck endorsing it? In this article, we will explore the world of reverse mortgages and shed light on Tom Selleck’s involvement.

Understanding Reverse Mortgages

A reverse mortgage is a loan that enables homeowners aged 62 and older to convert part of their home equity into cash. Instead of making monthly mortgage payments, reverse mortgage borrowers receive funds from the lender. The loan is repaid when the homeowner sells the house, moves out, or passes away.

One of the main benefits of a reverse mortgage is that it provides financial stability for retirees who may have limited income or savings. It allows them to tap into the equity they have built up in their homes over the years without having to sell their property or take on additional debt.

Why Tom Selleck Endorses Reverse Mortgages

Tom Selleck’s endorsement of reverse mortgages comes from personal experience. He witnessed firsthand how reverse mortgages helped his parents improve their quality of life during their retirement years. As a result, he became passionate about educating others about the benefits and potential of reverse mortgages.

Selleck believes that reverse mortgages can be a useful financial tool for seniors, allowing them to stay in their homes and maintain their independence. He is committed to spreading awareness and debunking the myths surrounding reverse mortgages to help others make informed decisions about their retirement finances.

Common Misconceptions About Reverse Mortgages

There are several misconceptions about reverse mortgages that often deter seniors from considering this financial option. Let’s debunk some of these myths:

| Myth | Fact |

|---|---|

| Reverse mortgages require giving up ownership of your home. | Homeowners retain ownership and can live in their homes as long as they choose. |

| Reverse mortgages are only for those in desperate financial situations. | Reverse mortgages can be beneficial for a wide range of retirees, regardless of their financial status. |

| Reverse mortgages have high upfront costs. | While there are fees involved, they can be rolled into the loan and paid over time. |

| Reverse mortgages are a burden on heirs. | Heirs have the option to pay off the loan or sell the home to repay the lender. |

Is a Reverse Mortgage Right for You?

While reverse mortgages can provide financial relief for seniors, it’s essential to consider your circumstances before making a decision. Here are a few factors to consider:

- Your long-term financial goals and retirement plans

- Your current and future housing needs

- Your understanding of the terms and obligations of a reverse mortgage

- Consulting with a financial advisor or housing counselor

Remember, a reverse mortgage is a significant financial decision, so it’s crucial to fully grasp the implications and potential risks. Educate yourself about the process, fees, and obligations before taking the next steps.

In Conclusion

Tom Selleck’s endorsement of reverse mortgages brings attention to a financial option that can improve the lives of many seniors. Reverse mortgages allow homeowners to leverage their home equity and enjoy much-needed financial stability during retirement. However, it’s essential to fully understand the terms and implications before embarking on this path.

By debunking the misconceptions surrounding reverse mortgages, Tom Selleck aims to empower seniors to make informed decisions about their financial futures. Remember to consult with professionals and thoroughly research your options before deciding if a reverse mortgage is right for you.

Frequently Asked Questions Of Tom Selleck And Reverse Mortgage: Unlocking The Financial Power

What Is A Reverse Mortgage?

A reverse mortgage is a type of loan for homeowners aged 62 and older, allowing them to convert part of their home equity into cash.

How Does A Reverse Mortgage Work?

With a reverse mortgage, the homeowner receives funds from the lender either as a lump sum, monthly payments, or as a line of credit, and the loan is repaid when the homeowner no longer occupies the home.

What Are The Benefits Of A Reverse Mortgage?

Reverse mortgages can provide seniors with additional income, allowing them to stay in their homes and enjoy a more comfortable retirement.

What Are The Potential Drawbacks Of A Reverse Mortgage?

One drawback is that interest and fees can accumulate over time, reducing the homeowner’s equity. It’s important to carefully consider the long-term implications before deciding to proceed with a reverse mortgage.

Ismail Hossain is the founder of Law Advised. He is an Divorce, Separation, marriage lawyer. Follow him.

Leave a Reply